RACHEL OAKES WRITES – When one company that is “too big to fail” can’t pay off its debts, that is no more than a data point. When two of these companies can’t pay off their debts, it’s a coincidence. When three companies from the Fortune Global 500 face pressing insolvency, you have found yourself in 2018 China.

Will the Chinese government let these powerhouses fail? In February,

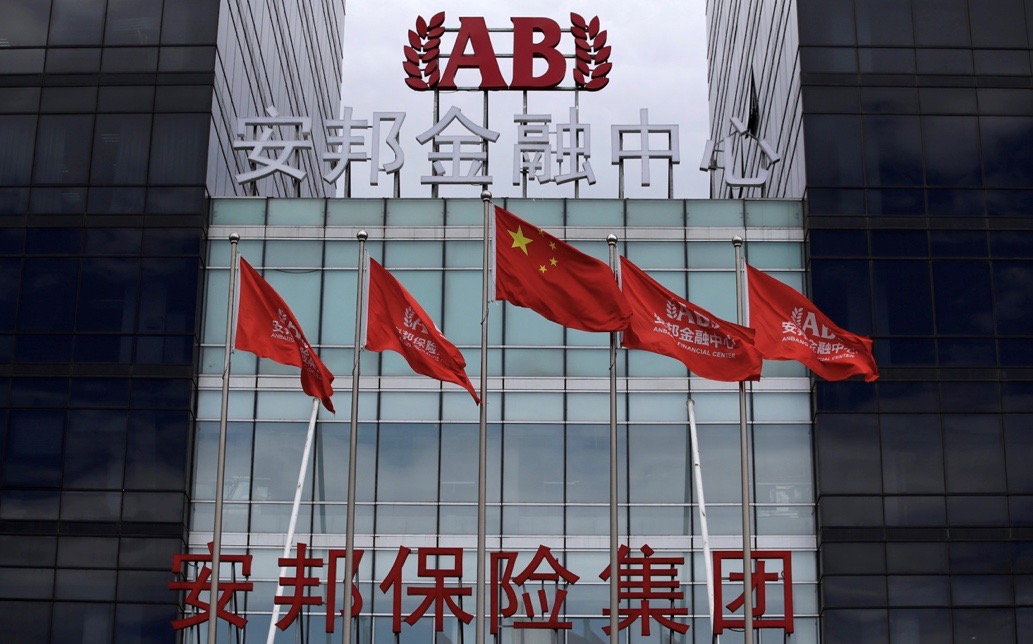

(a.k.a. CIRC) took control of Anbang Insurance Group, ranked 139 on Fortune’s Global 500. The Chinese State Council stated that, “illegal business practices by Anbang Insurance Group may seriously threaten the solvency of the company.”

Unfortunately, Anbang is not the only company in trouble. Dalian Wanda Group, numbered 380 on the Fortune Global 500, made headlines after “bottoming out” and selling 12.77 percent of Wanda Film’s shares. Furthermore, Wanda has been refused funding by Chinese banks since July of 2017. A third Chinese giant, HNA Group (ranked 170), announced on March 2 intentions of holding a selling spree worth over $1.4 billion. These acquisitions have been in HNA’s hands for less than a year, and are being sold to “ease its financial pressures…as Chinese authorities crack down.”

What’s surprising is that the Chinese government may have been the trigger for the initial downfall of these once looming powerhouses all along. The drama all lies in China’s push for FDI through mergers and acquisitions.

In the past decade, major Chinese companies received strong encouragement from the government to heavily engage in FDI. As a result, many companies did just that in certain foreign industries, specifically hotels and entertainment. Anbang intensely sought out properties such as the Financial Times, DoubleTree, Four Seasons hotels, and most famously, the Waldorf Astoria Hotel in Manhattan, New York. Dalian Wanda acquired a majority share in AMC Theaters, and Wanda Cultural Industry Group is China’s largest cultural enterprise, with a hand in film-production, sports, and movie theaters contributing 28 percent to overall revenue in 2017. HNA Group chased after Hilton Hotels Group and purchased controlling interest in 400 other prominent hotels across the globe.

To the surprise (and concern) of these companies, China had a change of heart regarding these foreign media and hotel acquisitions mid-2017. In June 2017, Anbang’s CEO was arrested after investigations regarding the company’s financial ability to pay off its recent acquisitions. China blocked Wanda Group’s access to local bank loans needed to further finance its pending overseas deals in July 2017. HNA Group sought to calm investors as it too faced government scrutiny regarding its solvency. In August, the State Council released a pronouncement from the National Development and Reform Commission restricting overseas investment specifically in film, entertainment, sports, and hotels.

Some news sources speculate these “political windshifts” may be an effort to curb the intense rate at which giants acquire foreign companies. However, the Chinese government seems to be playing a different game. Note that during summer 2017, China was also openly backing Zhejiang Geely Holding Group’s purchase of a startup researching to make flying cars, as well as Ruyi Group’s $1.3 billion acquisition of Armani. Moreover, Geely has been suspected of subsidy fraud and shadowy funding. However, it has not been affected by any restrictions or investigations by the Chinese government. In fact, it is suspected by several newspapers that the Chinese state was behind Geely’s $9 billion purchase of Volvo in December 2017.

Bernstein Research Group sent a note to the Financial Times, commenting that, “Geely’s buying spree is remarkable also for its timing, coming at a time when the likes of Wanda, HNA, and Anbang are in varying degrees of hot water for excessive overseas spending.”

It deserves special consideration that the industries specifically restricted in this pronouncement were primarily hotel and entertainment-centric. Furthermore, the selling spree from Anbang, Wanda, and HNA consists solely of entertainment and hotel companies. China will be focusing on shifting Anbang away from Wu’s strategy over the next year of official takeover. Wanda Group has been “squeezed” by China to sell its stake specifically in AMC. HNA Group has only announced selling stakes in Park Hotels & Resorts, which owns many Hilton properties across North America and Europe.

Meanwhile, China’s own media and entertainment industry has been steadily increasing over recent years. Furthermore, the government has relaxed domestic regulations for investment in some M&E sectors as a part of its most recent Five-Year Plan. It looks like China is working to develop domestically, especially in media and hotel sectors, while they simultaneously restrict foreign media and hotel investment. The Chinese state is sending a very explicit message: No one is safe if they don’t play by the rules.

As of now, it seems too early to determine whether China’s regulatory restrictions will pay off, or whether the rocky status of its major companies will cause harm to the economy. Regardless, it sets a precedent for the future– China has the leverage, and even companies “too big to fail” can face death at Xi Jinping’s stake.