TALIN DEROHANESSIANS WRITES – QR Codes in Asia are a hit!

This could be attributed to an increase in mobile devices sold with built – in QR Code readers as well as the overall increase in smartphone sales.

Quick review: Quick Response codes were first invented in the 1990’s, by a Japanese company, to track production and shipping in the automotive industry. Now these codes, which can hold more data than traditional bar codes, are being used as smartphone applications and promoted in marketing campaigns, most notably, for making mobile payments in China.

Accordingly, mobile payments have been on the rise. WeChat, founded by Tencent in 2011, is an extremely popular social media app that connects friends and families as well as businesses and consumers. Built-in instant messaging replaces traditional emails, but users can also access the app for mobile payments. WeChat provides a similar experience to its western counterparts such as, Instagram, Facebook and LinkedIn, etc., which are banned in the region. With QR Codes, then, consumers make mobile payments and scan the codes to add friends to their WeChat list. Foreign businesses can also use WeChat to enter the Asian market more effectively. QR Codes are truly versatile, even enabling customers to order food, ride the metro and unlock public bikes.

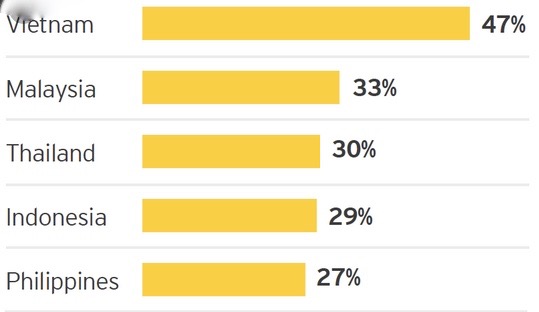

The West lags behind. According to a 2019 Price Waterhouse and Cooper (PWC) Global Consumer Insights Survey, QR codes are far more popular in Asian markets. China and Thailand, with Vietnam in the lead, are tops in the mobile payment market. The Vietnamese, in fact, plan to make financial transactions almost entirely electronic by 2020. Studies show that consumers use smartphones more than other digital devices for online spending. PWC reported that Yoox, a popular Italian online luxury fashion brand, has seen an increase in Net-a-Porter Group’s online sales, from shoppers on mobile devices to PCs and tablets. All this, it seems, is due to increased consumer spending and greater financial transparency. In addition, electronic payments helps rural consumers in areas where bank accounts are uncommon, but where they can use convenience stores and other storefronts to add value to their mobile wallets and digitize their cash.

US businesses may be trending toward cashless transactions, but they have a lot of catching up to do (even to rural Southeast Asia).